Latest News

Escaped Lerøy salmon may be diseased, experts fear

Some of the fish that escaped from a Lerøy Seafood facility in Norway could be carrying serious diseases, it is being reported. Some 14,000 salmon with an average weight of just over seven kilos got out of a Lerøy Midt facility...

Norway’s biological issues cut into Mowi’s Q1 profit

Mowi has today spoken of a biologically challenging 2024 first quarter at its Norwegian farms. The world's largest farmer of Atlantic salmon produced an operational profit or EBIT of €201m (£173m) between January and March this year. This is well...

Mowi Scotland recovery gathers pace

Mowi Scotland is bouncing back from the troubles which have hit financial performance recently. Results for the first quarter of this year, published today, show the Scotland division produced an operational EBIT or operational profit of €31.1m (£26.8m) up from...

Salmon Evolution heads into profit

Land-based salmon farmer Salmon Evolution has reported its first operational profit, in what the company has called a “significant milestone”. The Norway-based producer reported operating revenues of NOK 100.3m (£7.37m) in the first quarter of 2024 and a group EBITDA...

NEWSLETTER

Stay in touch with the latest developments from Fish Farmer and subscribe to our online updates

What's New

Marine Cranes Ltd launches services and partners with Iron Fist to expand crane distribution for the UK and Ireland

Newly formed Marine Cranes provides servicing, overhaul and sales to the marine industry across the UK and Ireland. It has recently acquired an exclusive dealership with IRON FIST to supply...

Heritage Global Partners: online auction

Auction, liquidation and asset advisory firm Heritage Global Partners is holding an online auction featuring vessels & intangible property from an innovative and patented aquaculture net washing company, Brunswick Jetters....

AlphaGeo promotes Chasing’s versatile ROVs

Marine services business AlphaGeo UK will be at Aquaculture UK this May, promoting the versatile range of remotely operated vehicles (ROVs) from China’s Chasing Innovation Tech Company, including the Chasing...

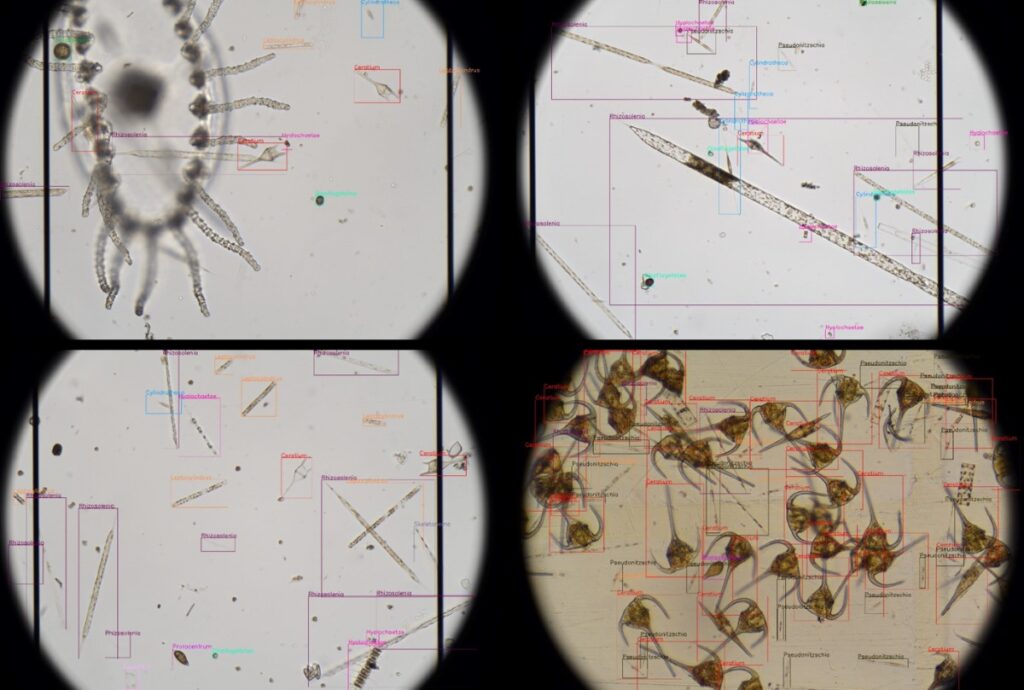

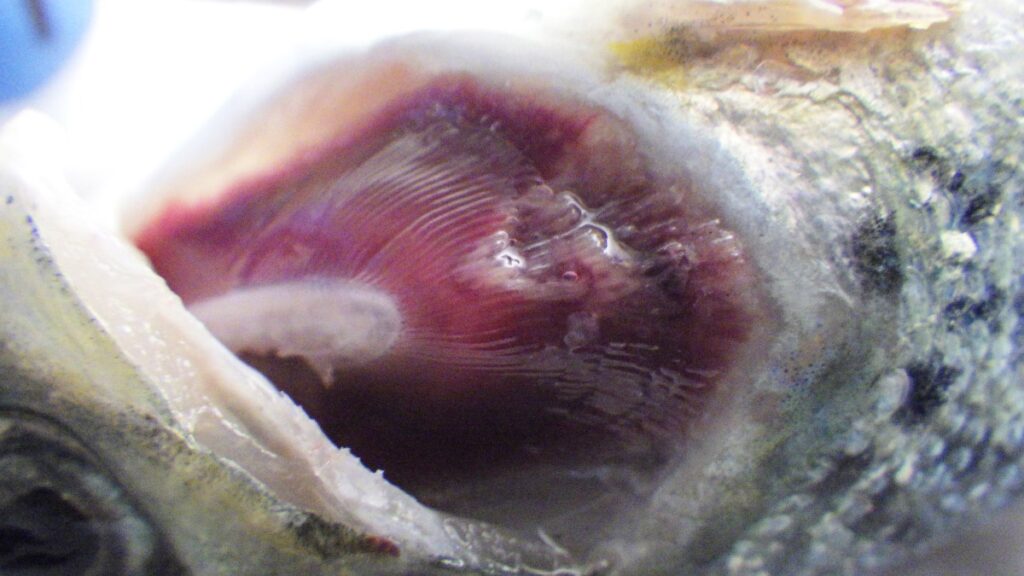

Tenacibaculosis – an alternative approach

The Center for Aquaculture Technologies Canada has launched a tenacibaculosis model to assist farms in combating growing disease challenges In 2023, the Norwegian salmon industry experienced the loss of 62.7...

Jobs

Electrical/Maintenance Engineer, Scottish Sea Farms – Girlsta Hatchery

At Scottish Sea Farms we are committed to supporting local economies in some of the most remote parts of the Scottish Highlands and Islands by providing employment and career development...

Marine Electrician, Scottish Sea Farms – Shetland Islands

We are currently recruiting for a Marine Electrician to join our Engineering team to service our Shetland Marine Farms. Responsible for the full service, maintenance and repair of the regions...

Features

An uphill task

The shellfish world is one full of contrasts, Nicki Holmyard finds As we gained plaudits, column inches and airtime in March for the wonderful benefits to the environment, biodiversity, ecosystem...

California dreaming

Kelp farming in America’s Golden State requires patience, as Julia Hollister reports Getting a licence to become a kelp farmer in California seems like a great idea. But before you...

Brokering a better Brexit deal

Salmon Scotland Chief Executive Tavish Scott says the coming general election is an opportunity to reset the UK’s relationship with the EU and smooth the vital flow of trade The...

Crystal clear

The Prairies, renowned as Canada’s breadbasket, is not the first place you would expect to find a fish farm – let alone one of the largest of its kind in...

Opinion

The speed of reaction

Opinion piece by Nick Joy I admit that my mind might not be quite on the job at the moment. Coming back from Sicily by car has been quite an...

Southern exposure

Scotland was well-represented at the Aquasur trade show in Chile, as Mairi Gougeon reports I have recently returned from an official visit to Chile, promoting Scotland’s aquaculture sector and exceptional...

Why we need exports

By Nick Joy Travelling to Europe is a wonderful thing for widening the mind but also reminding me how much we continue to depend on the good taste of our...

Building up an appetite

How to persuade UK consumers to eat more seafood was a key issue at the Norway-UK Seafood Summit, reports Dr Martin Jaffa At the end of February, Norway came to...

Events

Speakers confirmed for SAGB Conference

The British shellfish sector will be returning in force to London this month for the 54th Annual Conference of the Shellfish Association of Great Britain. This year’s conference is being...

Heritage Global Partners: online auction

Auction, liquidation and asset advisory firm Heritage Global Partners is holding an online auction featuring vessels & intangible property from an innovative and patented aquaculture net washing company, Brunswick Jetters....

First in-person Seagriculture Asia-Pacific conference set for next year

The first in-person event of Seagriculture Asia-Pacific will be premiering in Adelaide over 18-20 March 2025. This marks a pivotal moment for the Seagriculture Conferences, expanding their borders and venturing...

NEWSLETTER

Stay in touch with the latest developments from Fish Farmer and subscribe to our online updates