Salmon Evolution heads into profit

Land-based salmon farmer Salmon Evolution has reported its first operational profit, in what the company has called a “significant milestone”.

The Norway-based producer reported operating revenues of NOK 100.3m (£7.37m) in the first quarter of 2024 and a group EBITDA of NOK 24.1m (£1.77m), calculated on a back to farm basis and adjusting for transport costs.

In comparison, in Q1 last year Salmon Evolution recorded an EBITDA loss of NOK 22.4m (£1.65m).

CEO Trond Håkon Schaug-Pettersen said: “In Salmon Evolution we have a vision to grow salmon on land with excellent biology in a highly profitable way.

“The strong results in the first quarter are a testament to this and truly demonstrates that Salmon Evolution has established a unique, efficient and profitable growth platform. We are only at the start of our journey.”

Trond Håkon Schaug-Pettersen, CEO Salmon Evolution

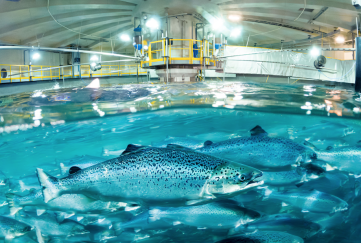

Salmon Evolution operates a hybrid flowthrough plant at Indre Harøy, on the Norwegian coast.

The company reported a financial loss of NOK 1.2m (£882,000), compared with a loss of NOK 32.4m (£2.38m) in the same quarter last year.

Q1 harvest volumes were 901 tonnes HOG (head on gutted), with average weight of 4.6 kg LW (live weight). The fish had a superior share of 96% and achieved strong price realisation, at around NOK 108/kg (£7.93).

At the end of the quarter, the company had a record high standing biomass of almost 2,700 tonnes LW, with stable growth. Biomass was up 8% from Q4 2023. This was despite poor smolt quality which led to reduced stocking. The company has secured external sources to ensure a supply of good quality smolt.

Mortality has been low, with the batches set for harvest in Q2 suffering accumulated mortality to date of 2.6%-3.7%.

Q2 harvest volumes are expected in the range of 1,600-1,800 tonnes HOG.

As well as continuing to grow production at the current facility, the company said its priorities remain developing Indre Harøy Phase 2 – “an improved copy of phase 1” – and developing overseas. Salmon Evolution is in the process of securing a site in North America and the company said: “We are in advanced negotiations on a high-potential site which ticks ‘all the boxes’ on size, topography and water parameters.”

Meanwhile the company said it was “defining the road ahead in Korea” with a focus on cost optimisation and capital discipline. Design work has been completed, and permitting is on track, the company reports, promising further clarification during Q2.