Ambition in the East

Vietnam is looking to grow its aquaculture – and to make it more efficient. Vince McDonagh reports

It might come as a surprise to some people to learn that Vietnam is the world’s fourth-largest producer of farmed fish, generating almost 4.9 million tonnes a year – three times that of Norway, for example.

Its products, of course, are quite different and so too are the methods; Norway is renowned for its salmon, trout and increasingly cod, while Vietnam is one of the largest producers of pangasius and black tiger prawns.

Pangasius, also known as basa or river cobbler, is now a familiar product on UK supermarket shelves. It is used by major UK seafood companies as an acceptable substitute for far more expensive whitefish such as cod.

With a population of around 100 million, Vietnam clearly has its own mouths to feed first. But the country’s importance to the global seafood market cannot be overestimated. Without this once isolated country, the world would be a hungrier place.

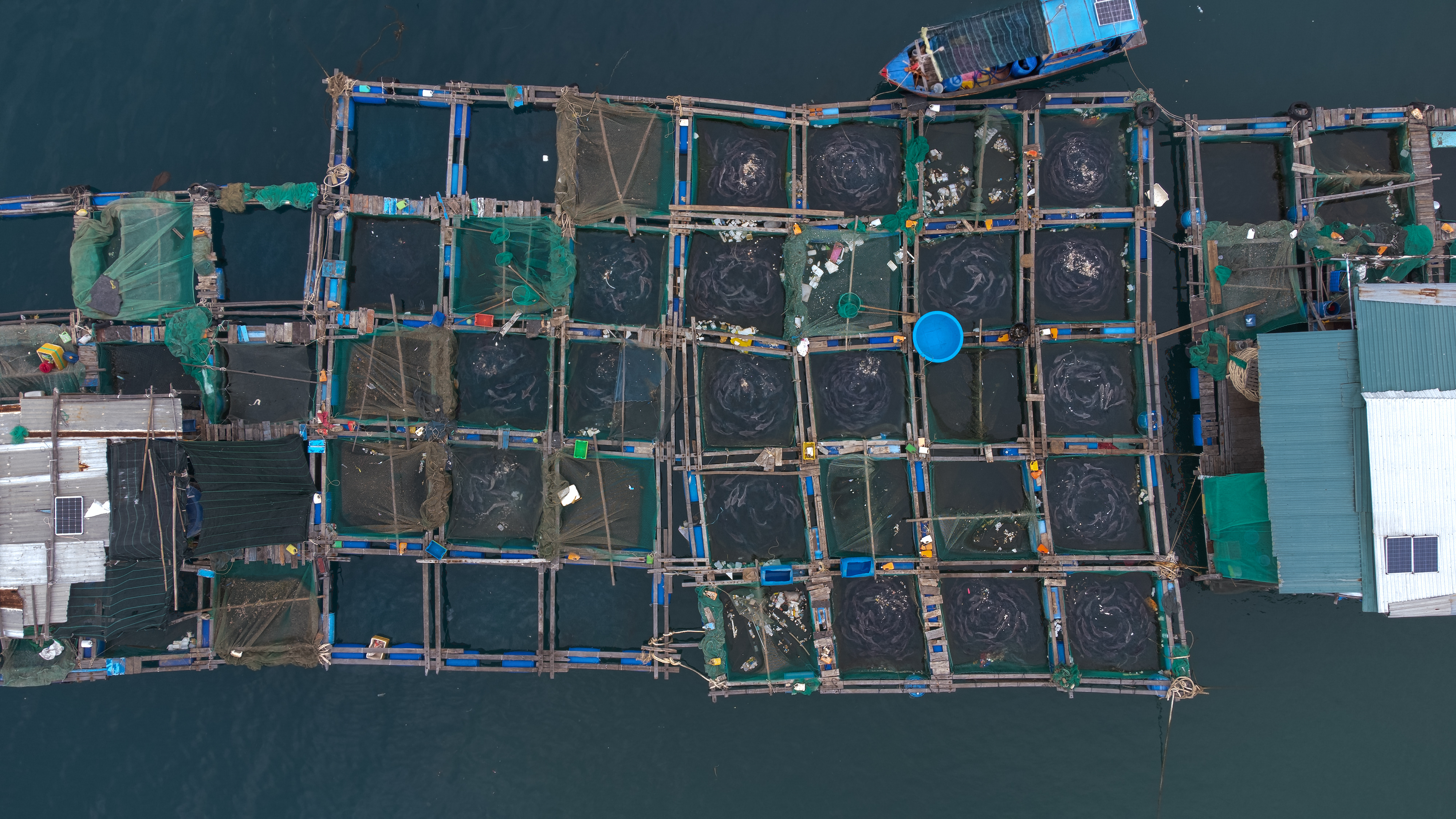

Ha Long, Vietnam

Export growth has been a key economic strategy for some time but it now planning an even greater assault on world markets.

The Hanoi government recently approved a major marine aquaculture development project aimed at reaching seven million tonnes by 2030, with a further strategy up to 2045, developing improvements in quality and value.

According to the Vietnam News Agency (vnanet), Dinh Hoe, General Secretary of the Vietnam Association of Seafood Exporters and Producers (VASEP), said the increase in global seafood demand meant Vietnam’s aquaculture product export turnover has maintained growth over many years.

It reached US $11bn (£8.7bn) in 2022, 12 times higher than that of a quarter of a century earlier when the country’s seafood sector first started to reach out to the rest of the world in a meaningful way.

The agency says that Vietnamese aquaculture products are not only growing in output but are considered an excellent source of protein, with stable quality and increasingly high nutritional value, contributing to ensuring a sound global food supply.

Vietnam has a number of advantages. First, seafood consumption is increasing globally while natural aquatic (wild fish) resources are limited, which meant seafood supply must rely on aquaculture.

Fish farm cultivation at sea. Aerial view. Seafood industry in Vietnam.

Vietnam also has a long coastline and sufficient water surface area for developing both brackish and freshwater aquaculture.

For example, Vietnam contributes about a million tonnes out of the total world shrimp production of six million tonnes a year.

The second advantage is that Vietnamese businesses are catching up with the world in processing technology, particularly deep processing, to make value-added products.

Thirdly, Vietnam has a widely and deeply integrated global network through signing and implementing new-generation of free trade agreements with countries and regions that are large consumption markets.

The industry remains fragmented, however, but has been working with countries such as Norway to improve its efficiency.

According to the agency, Vietnam’s seafood sector faces some disadvantages such as small-scale production, mostly through household farming, and the negative impact of climate change (now affecting even Nordic countries such as Norway).

In Vietnam, these changes were resulting in the shrinking of freshwater aquaculture areas.

Vietnam believes it has strengths in processing technology and consumption markets.

The agency adds: “The issue that its aquaculture sector needs to address now is how to optimise production costs through minimising input costs.

Vietnamese fish farmer

“Long-term solutions are also needed such as gradually increasing the rate of large-scale production, applying high technology to improve productivity and attracting investment in local animal feed and breed production to reduce its reliance on imported sources.”

Hoe said that Vietnamese aquacultural products are present in more than 170 countries and territories all over the world, so finding new markets is no longer a priority.

In the context of a decline in purchasing power in major markets, businesses and associations need to step up trade promotion to effectively exploit the potential of each market, he stressed.

Pangasius (Basa) fillets

On the green production and consumption trends, the VASEP representative said that Vietnam’s fisheries industry is “going green” quite well.

Up to 70% of raw materials used to make products for export are raised at farms. Vietnam has more and more farms and farming areas that have received international certifications for responsibly farmed aquatic products, minimising negative impacts on the environment, ecosystem and community, and meeting labour regulations.

Out of 847 industrial-scale factories with food safety certificates, more than 690 factories received codes for exporting products to the EU. For the important US market, Vietnamese products also meet the Best Aquaculture Practices standard.

Vietnam says it is committed to net zero emissions by 2050, so it is urging every industry and business to make moves towards the use of energy efficient equipment, renewable energy and low-carbon packaging.