Trump takes some pressure off Vietnamese seafood exporters

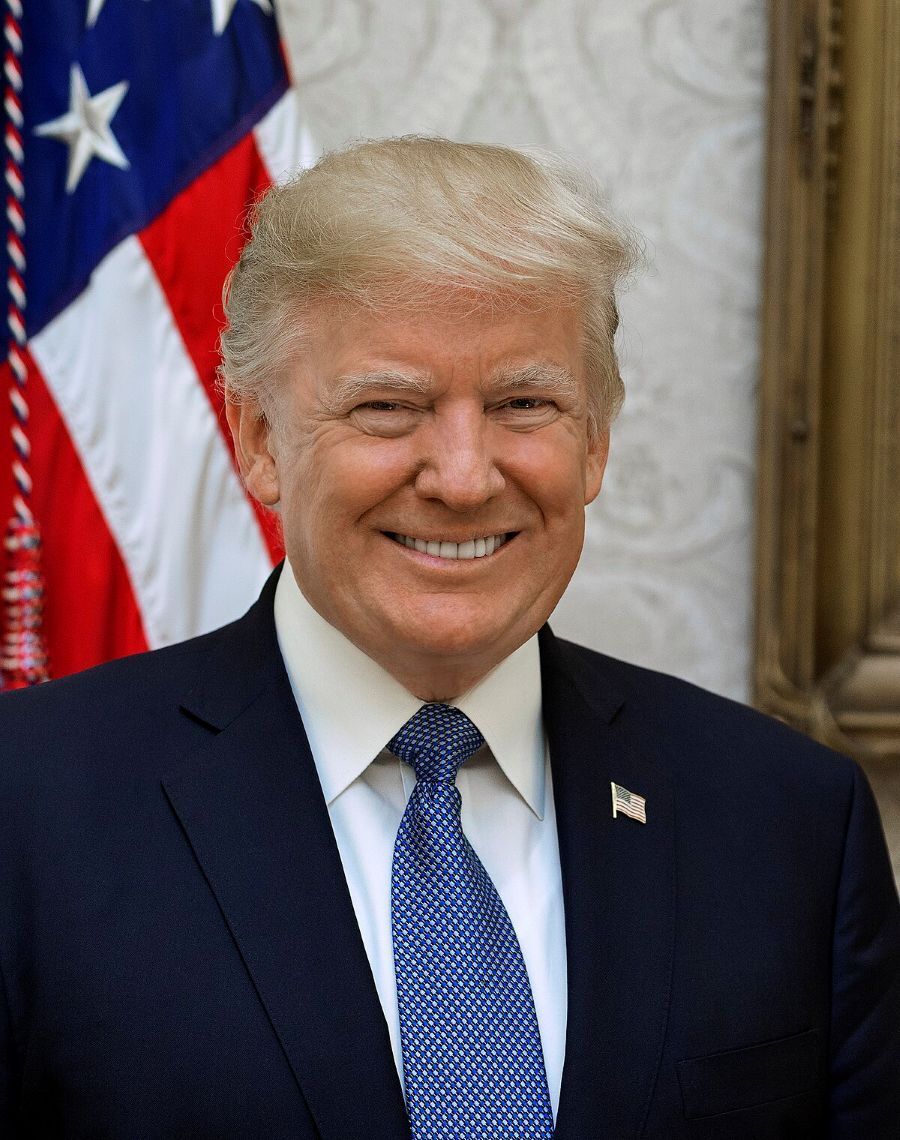

There was at least some relief for Vietnam’s aquaculture and seafood industries at the weekend when President Trump announced he was more than halving tariffs on the country.

Vietnam is a key supplier of farmed seafood to the US particularly shrimp and tilapia.

Vietnam’s seafood industry was clearly worried by the earlier threat which, if carried through, would have significantly raised food inflation for American consumers.

The levy, which was due to start in the next few days, has been cut from 46% to 20%, although it still means Vietnamese seafood will be more expensive from August 1st.

Politics rather than seafood is clearly playing a dominant role in this saga. Peter Navarro, Trump’s senior counsellor on trade and manufacturing, has said that a third of all Vietnamese exports to the US were actually Chinese products shipped through Vietnam.

Vietnam is a substantial seafood exporter to the US, Europe and Japan among its main markets and is worth around SS $1.5 billion (£1.1 bn) .

Sales hit $US 4.07 billion (£3bn) in the first five months of 2025, up 14% year-on-year, according to the Vietnam Association of Seafood Exporters and Producers (VASEP).

China, the US and Japan remained the top three markets, accounting for 20%, 16%, and 15% of total exports, respectively.

Shrimp remains the key export items, generating US $1.3 billion (£953,000) in revenue, a 33.5% year-on-year rise, driven by strong demand recovery in Japan and China.

Notably, lobster emerged as a standout growth driver, with export value skyrocketing by 295% to USD 335 million, an impressive leap that highlights Vietnam’s growing foothold in the premium seafood segment.

Pangasius exports maintained solid ground at US $640 million, up 10.4% year-on-year. While overall growth was moderate, value-added pangasius products surged by 49%, underscoring the success of strategies focused on boosting product value and market competitiveness.

Why not try these links to see what our Fish Farmer AI can tell you.

(Please note this is an experimental service)

Advanced Freshwater Hatchery Operator - Hendrix Genetics

Lochgilphead£27,026 to £30,887 per annum

Processing Operative - Bakkafrost Scotland Limited

Cairndow£26,393.68 to £27,713.36 per annum

Environmental Field Scientist - Mowi Scotland

Fort WilliamSalary On Application

Marine Operative - Bakkafrost Scotland Limited

PA30 8ET£34,472.50 per annum

Farm Technician (Rum) - Mowi Scotland

Small Isles£28,258 to £31,648 per annum