Marel rejects US takeover attempt

Icelandic seafood and food equipment manufacturer Marel has rejected takeover overtures from the US business John Bean Technologies (JBT).

The Chicago-based company had offered to buy Marel for around US $2.6 billion (about £2bn) – or around $3.40 per share (£2.68).

The Marel board has not ruled out accepting a better offer in future, however.

The JBT bid was made in a non-binding statement of intent regarding a possible offer for all shares in Marel.

Marel said in a brief announcement that the JBT statement was not in the interests of its shareholders. It did not take into account Marel’s operations, the board had concluded, or the risks inherent in the execution of the transaction.

The announcement added: “Marel’s declared strategy is clear in terms of external growth and opportunities for further consolidation within the sector, as evidenced by the implementation of the company’s strategy.

“In accordance with its role and responsibility, Marel’s board is ready to evaluate well-thought-out proposals that fully reflect Marel’s value.”

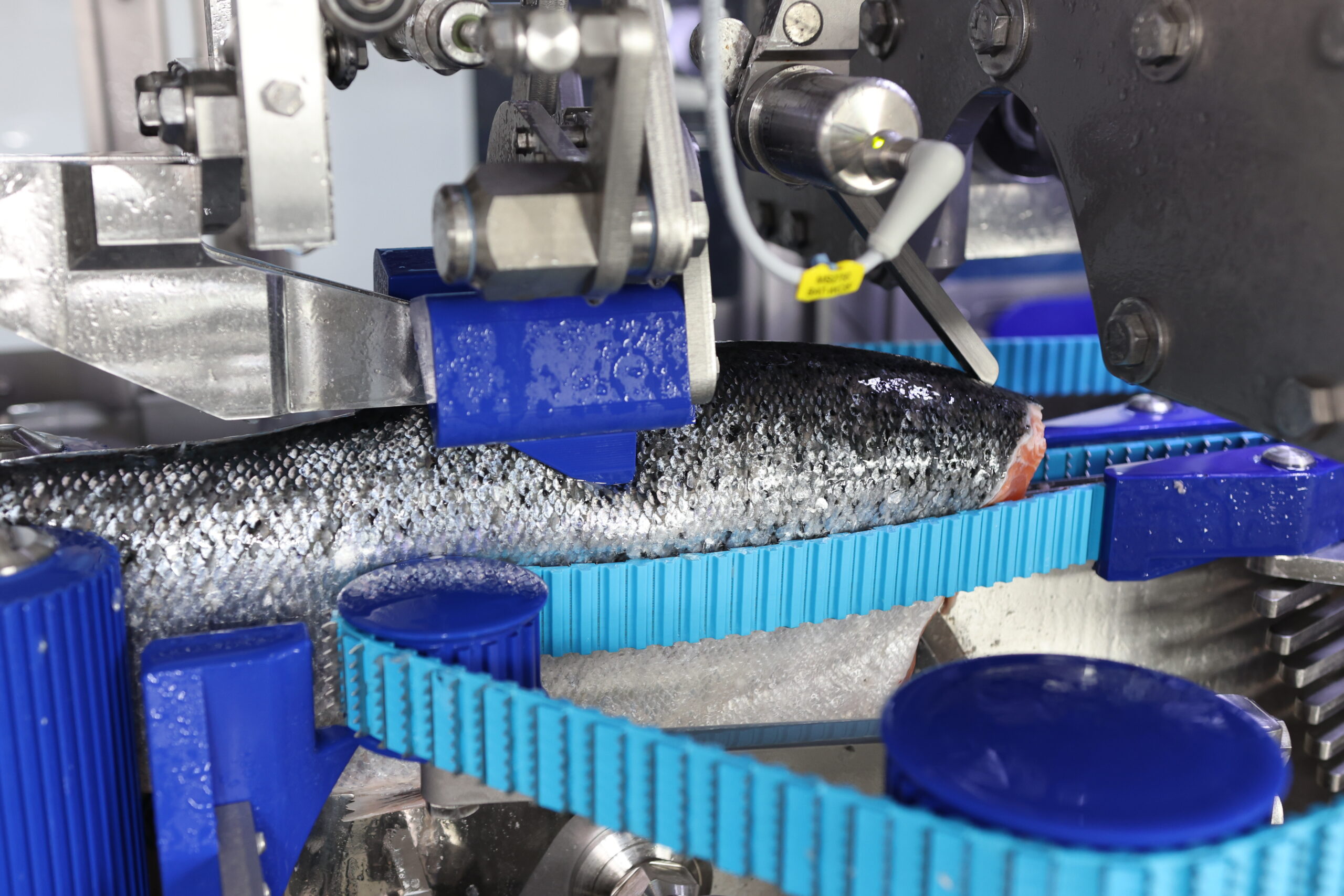

JBT, which is listed on the New York Stock Exchange, was formed in 2008 and has become a global leader in the production of technology solutions and services for the food and beverage industry. These include solutions for the processing of meat, seafood and poultry products, ready meals, storage packaged foods, juice and dairy products and fruit and vegetable products.

It has been an eventful few weeks for Marel. A month ago Arni Oddur Thordarson resigned suddenly as CEO after around 10 years at the helm. He has been credited with helping to transform the food processing industry.

Marel’s Deputy CEO Arni Sigurdsson has taken over as Interim Chief Executive.