Latest News

Label Rouge changes create more opportunity for Scotland’s salmon

Changes to France’s prestigious “Label Rouge” quality mark have been welcomed by Scottish salmon farmers. Industry body Salmon Scotland said the amended rules will help its plans to increase the sales of premium Scottish salmon in France and other European...

Loch Long’s Hawthorn in marathon effort

Loch Long Salmon’s Stewart Hawthorn has run the Boston Marathon, raising funds for an organisation that aims to preserve traditional Gaelic culture. Stirling-based Stewart Hawthorn – Managing Director at Loch Long Salmon – raised over £4,500 for the Gaelic Books...

Mowi ready for a further green bond issue

Salmon farming giant Mowi is set to raise additional finance through issuing more green bonds, the company announced yesterday. In a stock exchange announcement, Mowi said that it has mandated Danske Bank (Green Bond Advisor), DNB Markets, Nordea and SEB...

Arctic Fish escape investigation reopened after appeal

The Icelandic salmon farmer Arctic Fish is likely to face an investigation into its operations in the Westfjords after all. A decision by the police to drop an inquiry into the accidental release of salmon last year has now been...

Gigante confirms new CEO in board shake up

Norwegian land-based salmon farmer Gigante Salmon has a new Chief Executive and has also managed to receive commitment of NOK 120 million (almost £9m) in funding, the company has announced. Gigante Salmon had problems earlier this year, reporting significant mortality...

NEWSLETTER

Stay in touch with the latest developments from Fish Farmer and subscribe to our online updates

What's New

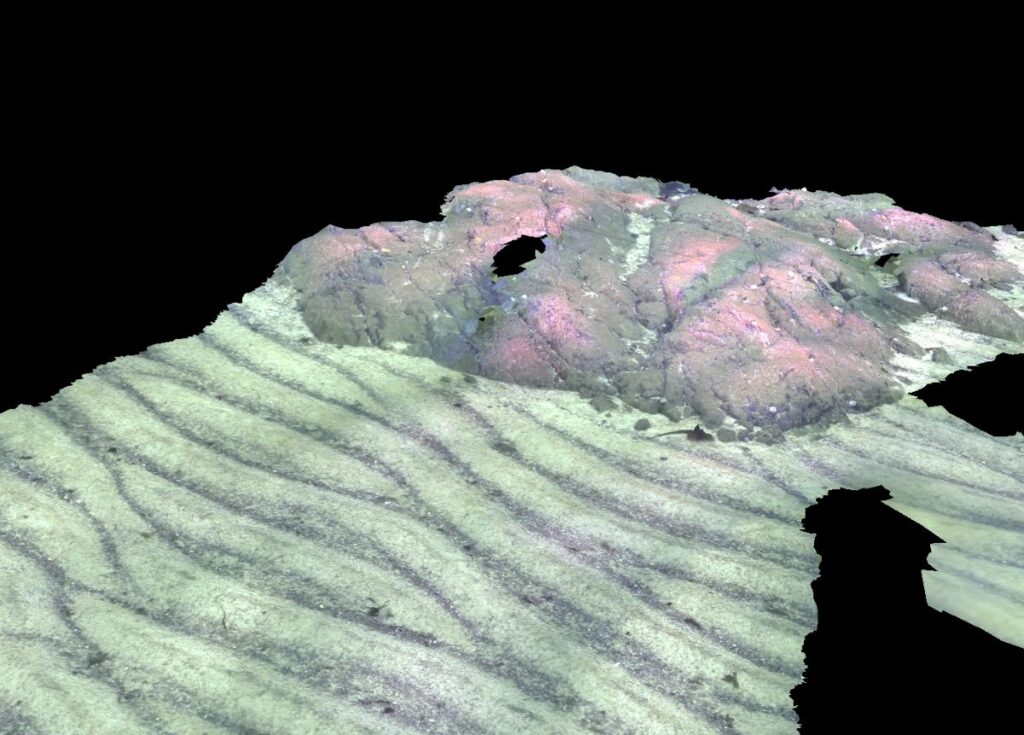

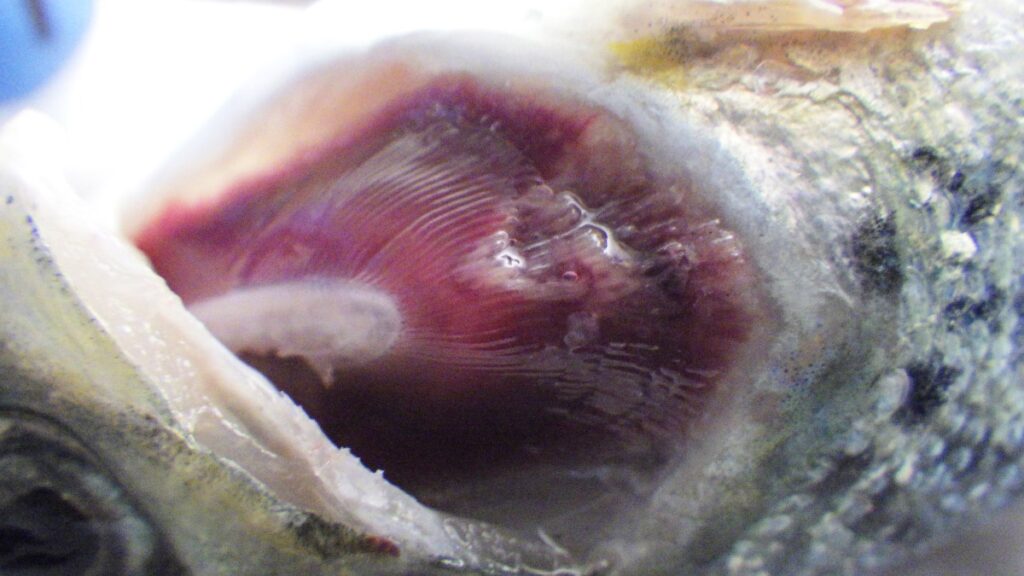

Tenacibaculosis – an alternative approach

The Center for Aquaculture Technologies Canada has launched a tenacibaculosis model to assist farms in combating growing disease challenges In 2023, the Norwegian salmon industry experienced the loss of 62.7...

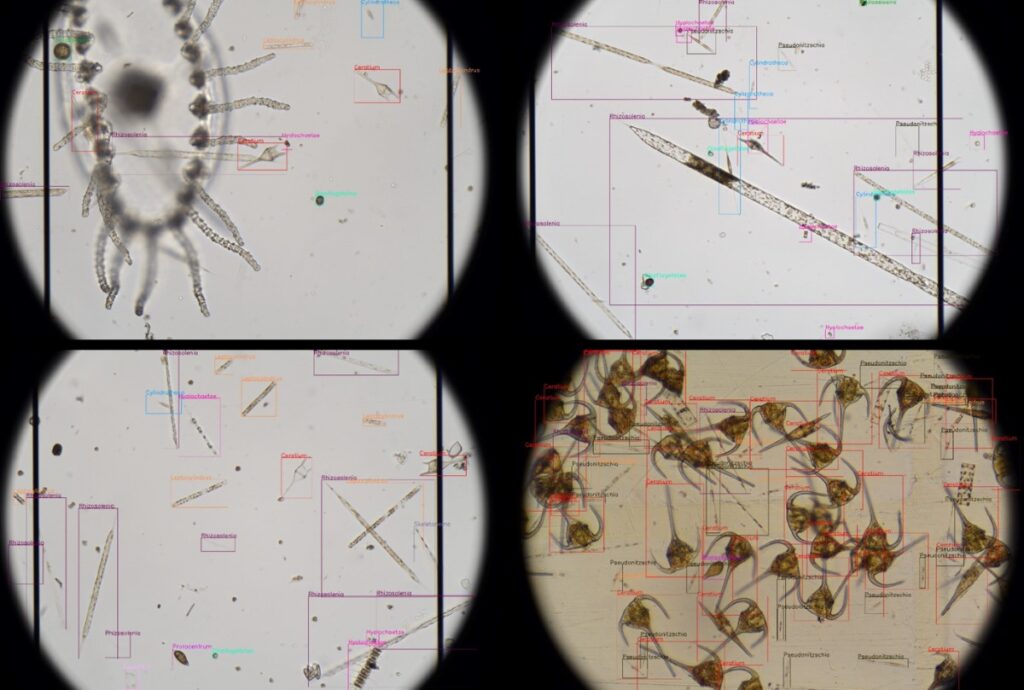

Revolutionising aquaculture safety

OTAQ introduces LPAS to combat harmful algae blooms: a game-changer in aquaculture monitoring Within the aquaculture industry there are increasingly frequent reports of Harmful Algal Blooms (HABS) being responsible for...

BIO-UV and Pinnacle in partnership for ozone treatments

BIO-UV Group has entered into an exclusive partnership agreement with US-headquartered Pinnacle Ozone Solutions to leverage the company’s QUADBLOCK Ozone water treatment products in Europe, Middle East, Africa and Asia. ...

Aquaculture technology and biosecurity

Advanced aquaculture technology is enhancing biosecurity and fish welfare, writes Iain Brown, Industry Sales Engineer, Xylem UK and Ireland Leading aquaculture experts from Xylem will deliver a keynote address at...

Jobs

Marine Engineering Technician, Bakkafrost

At Bakkafrost Scotland we see things from a FRESH perspective. And you can join us. The Marine Engineering Technician will work as directed by the Engineering Manager, across our Marine...

Features

Can you fillet?

Norway’s ban on the export of ‘inferior’ quality salmon is being challenged by the countries who want to process it, reports Vince McDonagh Is Norway heading for a potentially damaging...

Nothing beats getting together in person

Aquaculture industry companies and suppliers are looking forward to the sector’s biggest trade show in the UK As the UK’s leading trade show for the fish farming industry, Aquaculture UK...

Even more at Aviemore

This year’s edition of the UK’s leading aquaculture trade show promises to be bigger and better than ever This May will see the return of Aquaculture UK, which is once...

Opinion

The speed of reaction

Opinion piece by Nick Joy I admit that my mind might not be quite on the job at the moment. Coming back from Sicily by car has been quite an...

Southern exposure

Scotland was well-represented at the Aquasur trade show in Chile, as Mairi Gougeon reports I have recently returned from an official visit to Chile, promoting Scotland’s aquaculture sector and exceptional...

Why we need exports

By Nick Joy Travelling to Europe is a wonderful thing for widening the mind but also reminding me how much we continue to depend on the good taste of our...

Building up an appetite

How to persuade UK consumers to eat more seafood was a key issue at the Norway-UK Seafood Summit, reports Dr Martin Jaffa At the end of February, Norway came to...

Events

Nothing beats getting together in person

Aquaculture industry companies and suppliers are looking forward to the sector’s biggest trade show in the UK As the UK’s leading trade show for the fish farming industry, Aquaculture UK...

Packed programme for Aquaculture UK’s new Innovation Theatre

Aquaculture UK has unveiled the programme for its first ever Innovation Theatre, with presentations running in parallel with existing Keynote Theatre. The trade show and conference will be held over...

Data will drive the fish farm of the future

As technological advancements continue and costs become more accessible, how are traditional and modern fisheries adopting data-driven approaches and intelligent systems into their production processes? This will be one of...

NEWSLETTER

Stay in touch with the latest developments from Fish Farmer and subscribe to our online updates