Latest News

Loch Duart says new feed has improved fish health and cut carbon emissions

Independent salmon farmer Loch Duart says its switch a year ago to BioMar’s Blue Impact feed has reduced its carbon footprint, improved health for the stock and reduced natural impurities in its fish. The results of the analysis were announced...

Breaking news: Mowi loses first round in tax case

Mowi has lost the first round of a court battle against Norway’s “salmon tax”. A court in Hordaland, Norway has rejected the company’s lawsuit against the tax, also known as the ground rent or resource rent tax. The company said...

AlphaGeo promotes Chasing’s versatile ROVs

Marine services business AlphaGeo UK will be at Aquaculture UK this May, promoting the versatile range of remotely operated vehicles (ROVs) from China’s Chasing Innovation Tech Company, including the Chasing M2 Pro and Pro Max. They will also be talking...

Nova Scotia PM speaks out against Cooke fish farm plan

Nova Scotia Prime Minister Tim Houston (pictured) has come out firmly against Cooke Seafoods' plan to expand its Liverpool Bay salmon facility. In February he had already expressed his reservations about the project. Houston has now come off the fence,...

NEWSLETTER

Stay in touch with the latest developments from Fish Farmer and subscribe to our online updates

What's New

AlphaGeo promotes Chasing’s versatile ROVs

Marine services business AlphaGeo UK will be at Aquaculture UK this May, promoting the versatile range of remotely operated vehicles (ROVs) from China’s Chasing Innovation Tech Company, including the Chasing...

Tenacibaculosis – an alternative approach

The Center for Aquaculture Technologies Canada has launched a tenacibaculosis model to assist farms in combating growing disease challenges In 2023, the Norwegian salmon industry experienced the loss of 62.7...

Revolutionising aquaculture safety

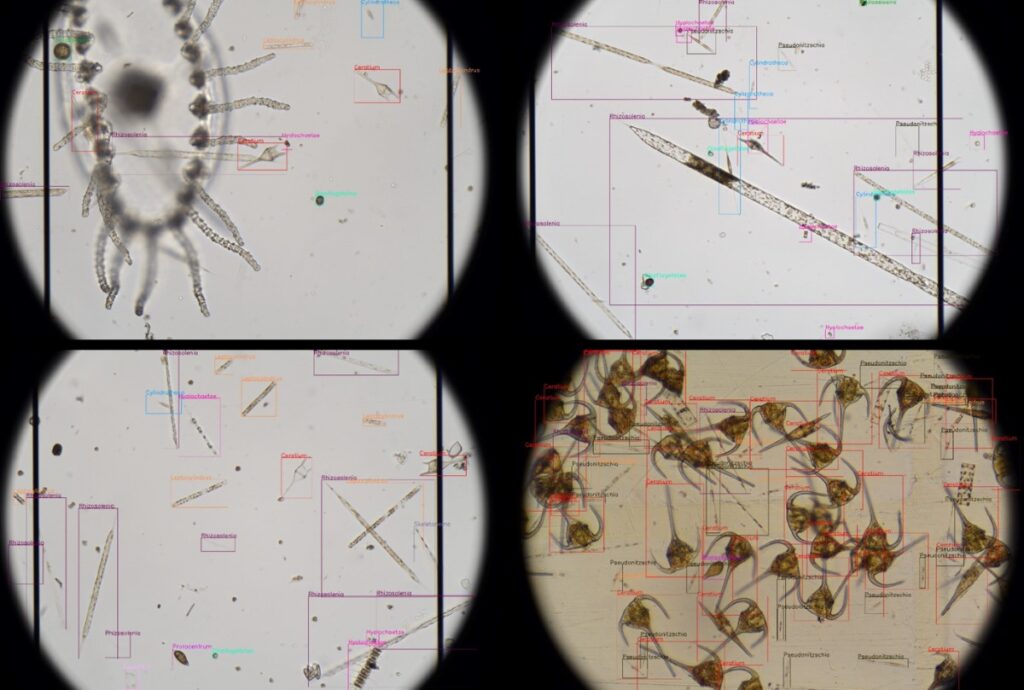

OTAQ introduces LPAS to combat harmful algae blooms: a game-changer in aquaculture monitoring Within the aquaculture industry there are increasingly frequent reports of Harmful Algal Blooms (HABS) being responsible for...

BIO-UV and Pinnacle in partnership for ozone treatments

BIO-UV Group has entered into an exclusive partnership agreement with US-headquartered Pinnacle Ozone Solutions to leverage the company’s QUADBLOCK Ozone water treatment products in Europe, Middle East, Africa and Asia. ...

Jobs

Marine Engineering Technician, Bakkafrost

At Bakkafrost Scotland we see things from a FRESH perspective. And you can join us. The Marine Engineering Technician will work as directed by the Engineering Manager, across our Marine...

Features

Stark numbers

The latest report from the Norwegian Veterinary Institute indicates that the industry is still failing to get a grip on salmon and trout mortalities. Vince McDonagh reports The figures are...

Can you fillet?

Norway’s ban on the export of ‘inferior’ quality salmon is being challenged by the countries who want to process it, reports Vince McDonagh Is Norway heading for a potentially damaging...

Nothing beats getting together in person

Aquaculture industry companies and suppliers are looking forward to the sector’s biggest trade show in the UK As the UK’s leading trade show for the fish farming industry, Aquaculture UK...

Opinion

The speed of reaction

Opinion piece by Nick Joy I admit that my mind might not be quite on the job at the moment. Coming back from Sicily by car has been quite an...

Southern exposure

Scotland was well-represented at the Aquasur trade show in Chile, as Mairi Gougeon reports I have recently returned from an official visit to Chile, promoting Scotland’s aquaculture sector and exceptional...

Why we need exports

By Nick Joy Travelling to Europe is a wonderful thing for widening the mind but also reminding me how much we continue to depend on the good taste of our...

Building up an appetite

How to persuade UK consumers to eat more seafood was a key issue at the Norway-UK Seafood Summit, reports Dr Martin Jaffa At the end of February, Norway came to...

Events

Nothing beats getting together in person

Aquaculture industry companies and suppliers are looking forward to the sector’s biggest trade show in the UK As the UK’s leading trade show for the fish farming industry, Aquaculture UK...

Packed programme for Aquaculture UK’s new Innovation Theatre

Aquaculture UK has unveiled the programme for its first ever Innovation Theatre, with presentations running in parallel with existing Keynote Theatre. The trade show and conference will be held over...

Data will drive the fish farm of the future

As technological advancements continue and costs become more accessible, how are traditional and modern fisheries adopting data-driven approaches and intelligent systems into their production processes? This will be one of...

NEWSLETTER

Stay in touch with the latest developments from Fish Farmer and subscribe to our online updates