Latest News

Aquaculture technology and biosecurity

Advanced aquaculture technology is enhancing biosecurity and fish welfare, writes Iain Brown, Industry Sales Engineer, Xylem UK and Ireland Leading aquaculture experts from Xylem will deliver a keynote address at Aquaculture UK, taking place at Aviemore, Scotland, 14-15 May 2024....

EU salmon processors increase prod-fish pressure

European Union salmon processors are demanding that Norway calls an end to the ban on exporting “prod” or damaged fish. The joint call, has come from the EU Salmon Processors Union which includes key countries such as Poland, Denmark and...

Norwegian salmon prices hit new record

Fresh salmon prices hit an all time record in Norway last week, although there are signs the surge could be over. They soared to NOK 123.28 per kilo during week 15, an increase of NOK 3.34 per kilo or 2.2%...

Mowi Scotland Q1 30% higher, but global output down

Mowi Scotland produced an encouragingly higher harvest during the first three months of this year, a trading update today shows. The output between January and March from the division, which has suffered from biological and other issues in the past,...

Making sure every fish counts behind new partnership move

The aquaculture technology specialist company Ace Aquatec is leading a new partnership to improve salmon farming’s circular economy. Pictured: Ace Aquatec Head of Sales Ben Perry and Senior Field Services Manager Ian Lawson with the A-HCS®. The move involves collaboration...

NEWSLETTER

Stay in touch with the latest developments from Fish Farmer and subscribe to our online updates

What's New

Aquaculture technology and biosecurity

Advanced aquaculture technology is enhancing biosecurity and fish welfare, writes Iain Brown, Industry Sales Engineer, Xylem UK and Ireland Leading aquaculture experts from Xylem will deliver a keynote address at...

UCO nets a solution to the problem of containment

Maintaining the integrity of nets is essential for a fish farm – but can be expensive. Fortunately, there is an answer to the dilemma Containment of stock is a key...

Enhancing aquaculture operations

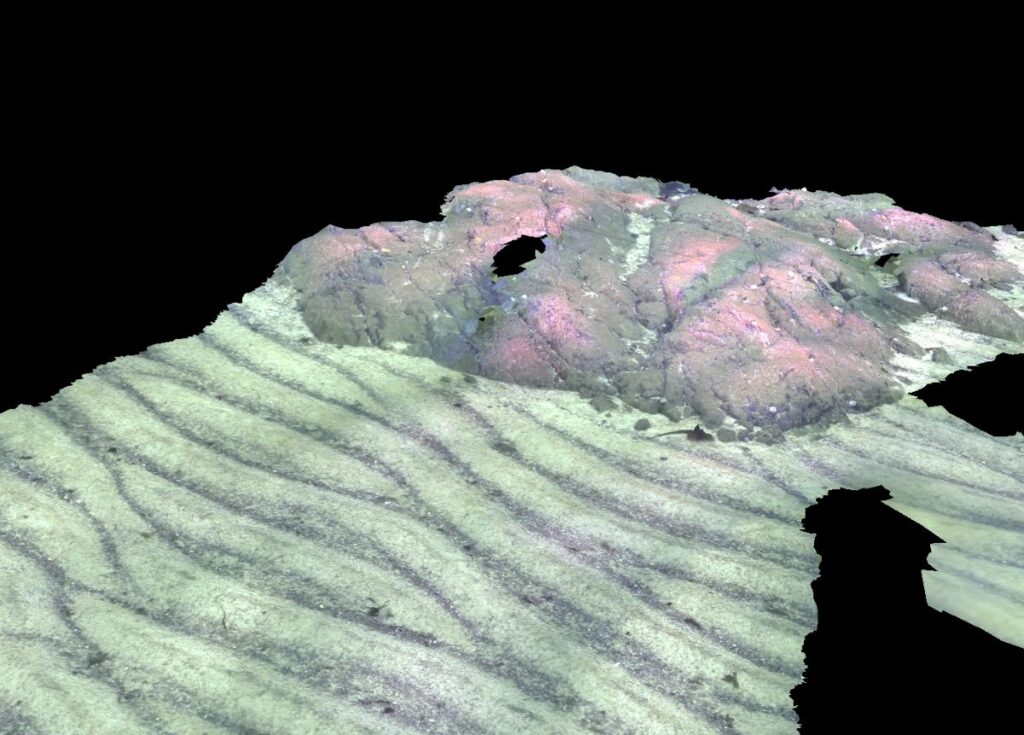

A comprehensive solution from Tritonia and Ocean Ecology Tritonia Scientific provide underwater surveying through the use of remote sensing techniques (multibeam, sidescan and ROV – remotely operated vehicle – visual...

Elevate your fish farming with robotics solutions

Staying competitive in the dynamic fish farming industry requires a comprehensive approach to cover a multitude of inspections. Here to help is ARV-i, a state-of-the-art underwater robot designed by Boxfish...

Jobs

Quality Monitor, Lerwick

We’re currently recruiting for a Quality Monitor at our Lerwick processing plant. The role is within our Quality team who are responsible for ensuring the highest welfare, food safety and...

Senior Husbandry, Orkney

Are you a highly motivated individual looking to expand your career? We are currently recruiting for a Senior Husbandry role to support the Farm manager in the day-to-day operation of...

Features

Fit for an emperor

A RAS farm in Germany has been leading the way in raising pike-perch for the table at a commercial scale. Robert Outram reports Mark Saalmann has some advice for any...

Emerging innovations for the shellfish industry

Innovation could help the shellfish industry adapt to restrictions posed since Brexit, writes Martin Sutcliffe Water quality is an important issue for the aquaculture sector and can be incredibly varied...

Fjords, the Faroes and flying fish

For a small fish farming nation, this rocky archipelago punches above its weight, writes Robert Outram. Additional reporting: Vince McDonagh The Faroese Research establishment formerly known as Fiskaaling has a...

Opinion

The speed of reaction

Opinion piece by Nick Joy I admit that my mind might not be quite on the job at the moment. Coming back from Sicily by car has been quite an...

Southern exposure

Scotland was well-represented at the Aquasur trade show in Chile, as Mairi Gougeon reports I have recently returned from an official visit to Chile, promoting Scotland’s aquaculture sector and exceptional...

Why we need exports

By Nick Joy Travelling to Europe is a wonderful thing for widening the mind but also reminding me how much we continue to depend on the good taste of our...

Building up an appetite

How to persuade UK consumers to eat more seafood was a key issue at the Norway-UK Seafood Summit, reports Dr Martin Jaffa At the end of February, Norway came to...

Events

Packed programme for Aquaculture UK’s new Innovation Theatre

Aquaculture UK has unveiled the programme for its first ever Innovation Theatre, with presentations running in parallel with existing Keynote Theatre. The trade show and conference will be held over...

Data will drive the fish farm of the future

As technological advancements continue and costs become more accessible, how are traditional and modern fisheries adopting data-driven approaches and intelligent systems into their production processes? This will be one of...

Minister to open Aquaculture UK conference

Scotland’s Rural Affairs Minister, Mairi Gougeon, will head an exciting line-up of speakers at Aquaculture UK, which gets underway in Aviemore in two months’ time. The keynote theatre programme, now...

NEWSLETTER

Stay in touch with the latest developments from Fish Farmer and subscribe to our online updates