Latest News

Even more at Aviemore

This year’s edition of the UK’s leading aquaculture trade show promises to be bigger and better than ever This May will see the return of Aquaculture UK, which is once more being held in Aviemore in the Scottish Highlands. With...

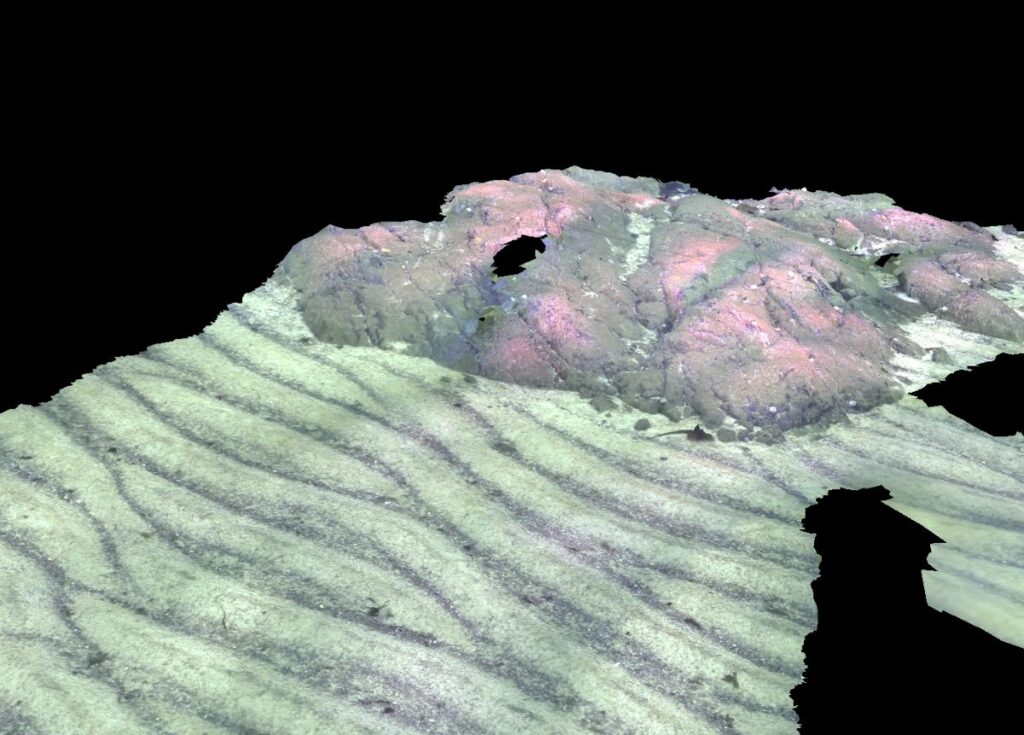

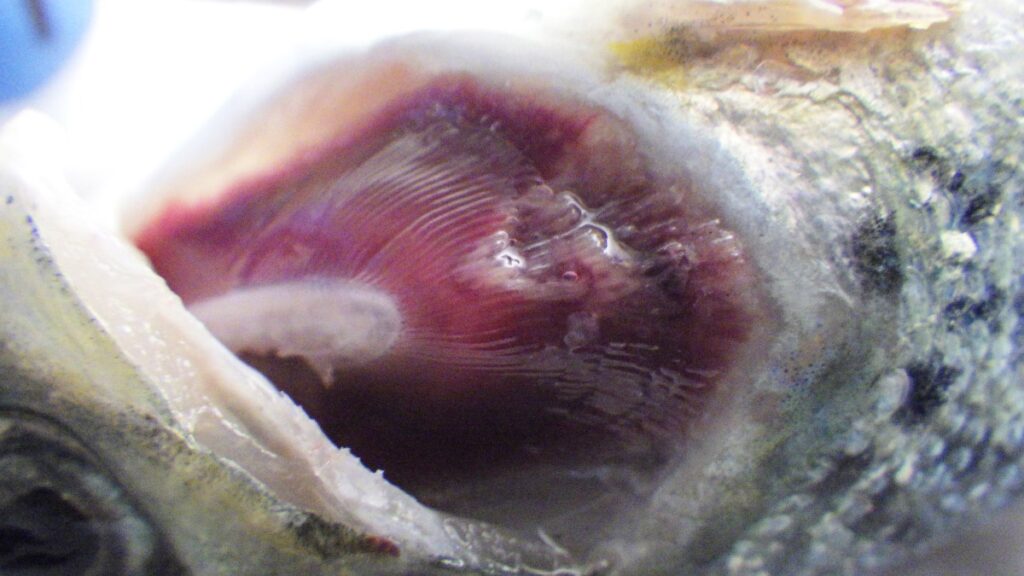

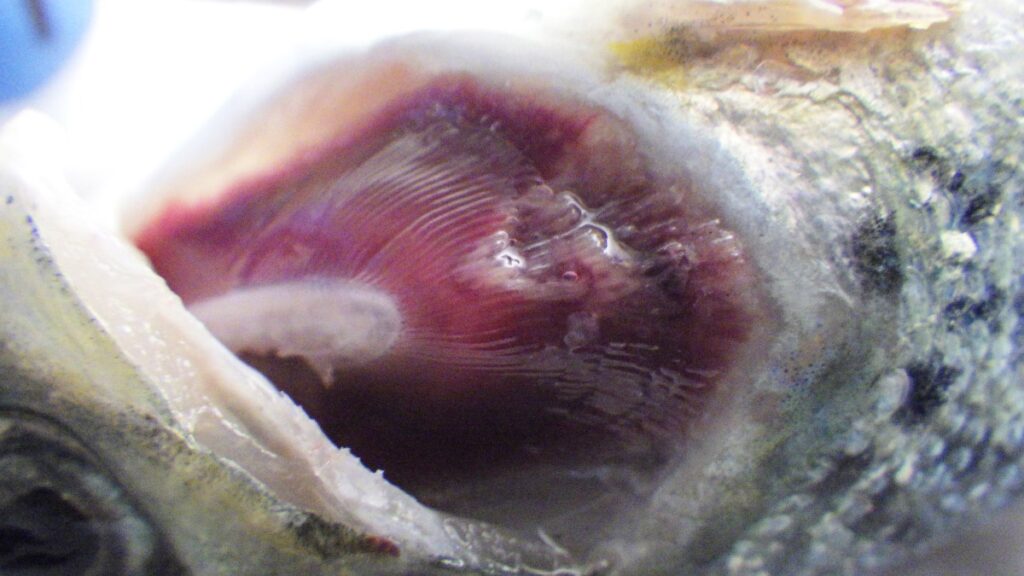

Tenacibaculosis – an alternative approach

The Center for Aquaculture Technologies Canada has launched a tenacibaculosis model to assist farms in combating growing disease challenges In 2023, the Norwegian salmon industry experienced the loss of 62.7 million Atlantic salmon before they reached market size, marking an...

Revolutionising aquaculture safety

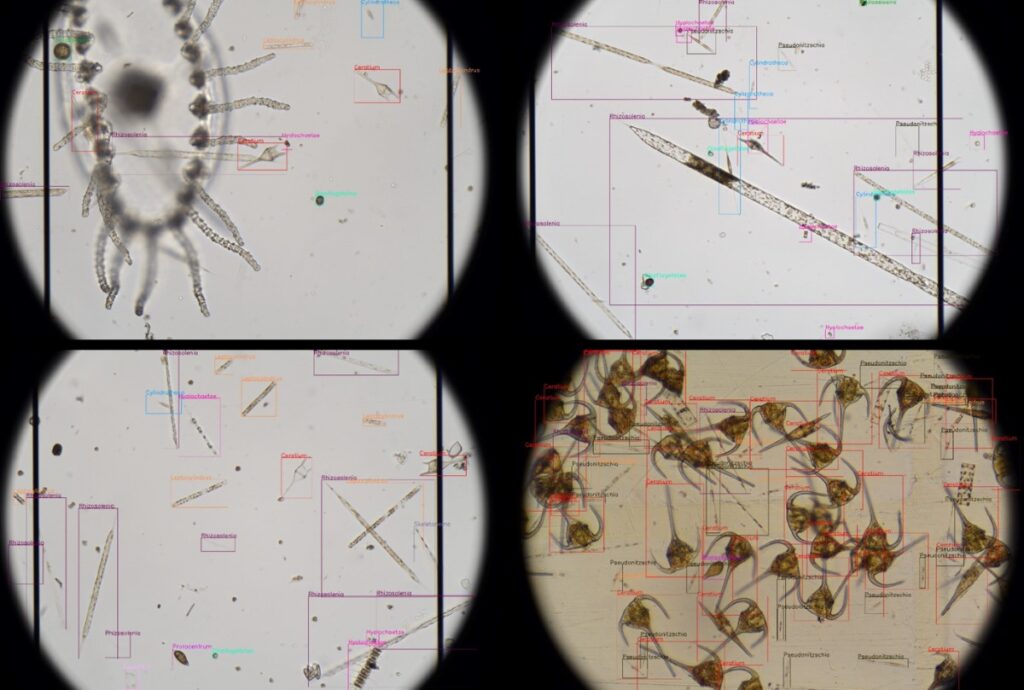

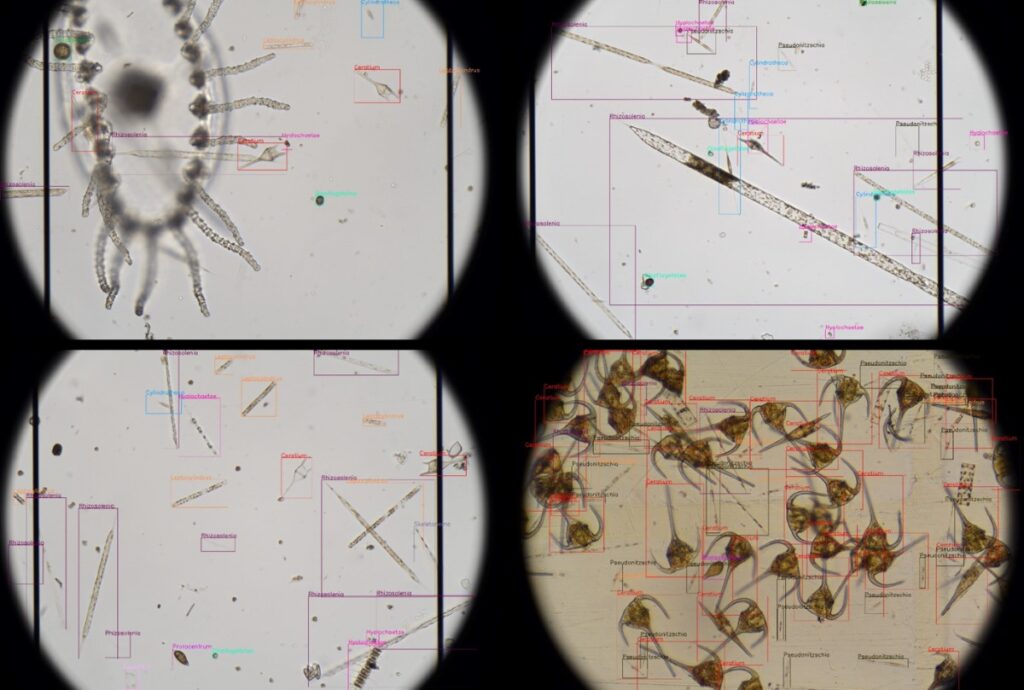

OTAQ introduces LPAS to combat harmful algae blooms: a game-changer in aquaculture monitoring Within the aquaculture industry there are increasingly frequent reports of Harmful Algal Blooms (HABS) being responsible for devastating fish kill events, in some cases with a single...

BIO-UV and Pinnacle in partnership for ozone treatments

BIO-UV Group has entered into an exclusive partnership agreement with US-headquartered Pinnacle Ozone Solutions to leverage the company’s QUADBLOCK Ozone water treatment products in Europe, Middle East, Africa and Asia. Pinnacle is one of the largest suppliers of ozone technology...

Major setback for US East Coast salmon farm plan

A plan for a large salmon farm on the US East Coast is hanging in the balance following a controversial decision by the local city council. Nordic Aquafarms has been trying for years to build the $500 million facility near...

Nordic Aqua Partners completes first commercial China harvest

Nordic Aqua Partners has announced the successful completion of its first commercial harvest of Atlantic salmon produced at its facility in Gaotang, eastern China. The company described the achievement as a major operational milestone for Nordic Aqua which would now...

NEWSLETTER

Stay in touch with the latest developments from Fish Farmer and subscribe to our online updates

What's New

Tenacibaculosis – an alternative approach

The Center for Aquaculture Technologies Canada has launched a tenacibaculosis model to assist farms in combating growing disease challenges In 2023, the Norwegian salmon industry experienced the loss of 62.7...

Revolutionising aquaculture safety

OTAQ introduces LPAS to combat harmful algae blooms: a game-changer in aquaculture monitoring Within the aquaculture industry there are increasingly frequent reports of Harmful Algal Blooms (HABS) being responsible for...

BIO-UV and Pinnacle in partnership for ozone treatments

BIO-UV Group has entered into an exclusive partnership agreement with US-headquartered Pinnacle Ozone Solutions to leverage the company’s QUADBLOCK Ozone water treatment products in Europe, Middle East, Africa and Asia. ...

Aquaculture technology and biosecurity

Advanced aquaculture technology is enhancing biosecurity and fish welfare, writes Iain Brown, Industry Sales Engineer, Xylem UK and Ireland Leading aquaculture experts from Xylem will deliver a keynote address at...

Jobs

Quality Monitor, Lerwick

We’re currently recruiting for a Quality Monitor at our Lerwick processing plant. The role is within our Quality team who are responsible for ensuring the highest welfare, food safety and...

Senior Husbandry, Orkney

Are you a highly motivated individual looking to expand your career? We are currently recruiting for a Senior Husbandry role to support the Farm manager in the day-to-day operation of...

Features

Even more at Aviemore

This year’s edition of the UK’s leading aquaculture trade show promises to be bigger and better than ever This May will see the return of Aquaculture UK, which is once...

Fit for an emperor

A RAS farm in Germany has been leading the way in raising pike-perch for the table at a commercial scale. Robert Outram reports Mark Saalmann has some advice for any...

Emerging innovations for the shellfish industry

Innovation could help the shellfish industry adapt to restrictions posed since Brexit, writes Martin Sutcliffe Water quality is an important issue for the aquaculture sector and can be incredibly varied...

Opinion

The speed of reaction

Opinion piece by Nick Joy I admit that my mind might not be quite on the job at the moment. Coming back from Sicily by car has been quite an...

Southern exposure

Scotland was well-represented at the Aquasur trade show in Chile, as Mairi Gougeon reports I have recently returned from an official visit to Chile, promoting Scotland’s aquaculture sector and exceptional...

Why we need exports

By Nick Joy Travelling to Europe is a wonderful thing for widening the mind but also reminding me how much we continue to depend on the good taste of our...

Building up an appetite

How to persuade UK consumers to eat more seafood was a key issue at the Norway-UK Seafood Summit, reports Dr Martin Jaffa At the end of February, Norway came to...

Events

Packed programme for Aquaculture UK’s new Innovation Theatre

Aquaculture UK has unveiled the programme for its first ever Innovation Theatre, with presentations running in parallel with existing Keynote Theatre. The trade show and conference will be held over...

Data will drive the fish farm of the future

As technological advancements continue and costs become more accessible, how are traditional and modern fisheries adopting data-driven approaches and intelligent systems into their production processes? This will be one of...

Minister to open Aquaculture UK conference

Scotland’s Rural Affairs Minister, Mairi Gougeon, will head an exciting line-up of speakers at Aquaculture UK, which gets underway in Aviemore in two months’ time. The keynote theatre programme, now...

NEWSLETTER

Stay in touch with the latest developments from Fish Farmer and subscribe to our online updates